INFAH has formed various Subcommittees to have a more focused approach in all pertinent areas of Animal health. Members of subcommittees are either the professionals working in respective industry or posssessing core skills and expertise they can bring to table to represent challenges and recommend solutions. Looking at the bigger picture, this division helps all members with a better understanding of Animal Health and encourages a scientific approach that facilitates the supply of innovative, cost-effective and quality products & services.

- Therapeutics & Disinfectants Subcommittee deals with not only the concerns but also the exploration of future aspects of Animal health products.

- Biological and Biosecurity Subcommittee is formed to work progressively towards identifying the potential of biological products, challenges and control of microbial infections.

- Herbal Subcommittee has core focus of engaging in analysis and strengthening the future of Ayurveda and herbal products both in India and across the world.

- Feed Supplement Subcommittee carries the responsibility of representing issues of supplements across the species and also exploring new areas of development.

- Subcommittee of Good Manufacturing Practices (GMP) and Corporate Social Responsibility (CSR) aims to work forward for better and ethical practices for the animal health industry and serving the society and the Veterinary profession as a whole.

- Imports and Exports Subcommittee is poised to contribute towards making our industry sustainable and ensuring global technologies into India and Indian exports to the global markets.

- Human Resource and its management is an area of concern for all industries and the newly constituted Human Resource Subcommittee would contribute in devising options for better potential manpower availability for the Animal health industry.

- Aqua Subcommitee has prime objective of analysing and representing current and future potential issues of species healthcare, feed supplement and pond management challanges.

- Companion Animal Subcommitte works on emerging regulatory and healthcare policy framework. The objective is to keep the pace with rapid growth and need of small animal practice as well as associated pet industry segments.

Mr. Mohanji Saxena

Mr. K P Philip

Mr. K K Unni

Dr. M L Kanchan

Dr. S N Singh

Mr. Bharat Tandon

Special Awardee: Dr. Romila Iyer

Dr. C. S. Bedi

Dr. Subhash Ramarao Kumthekar

Dr. Shriprakash Arora

Shri S. S. Chousalkar

Dr. Y. G. Deshpande

Dr. Atma Prakash Mamtani

Dr. Asoke Bannerjee

Shri Shushil Kumar Agarwal

Shri Ravindra Kumar Agarwal

Dr. Vilas Adhikari

Dr. Asim Banerjee

Dr. Pandu Ranga Rao

Animal Husbandry in India

India has vast resources of livestock and poultry, which play a vital role in improving the socio-economic conditions of rural masses. There are about 303.76 million bovines, 74.26 million sheep, 148.88 million goats, 9.06 million pigs and about 851.81 million poultry as per 20th Livestock Census in the country.

| Species | 20th LS Census [2019] Millions |

Projected 2030 Millions & Gr % [2020-21] |

|---|---|---|

| Cattle | 193.46 | 196 [+1.2%] |

| Buffalo | 109.85 | 112 [+1.04%] |

| Sheep | 74.26 | 80 [+8%] |

| Goat | 148.88 | 160 [+8%] |

| Pig | 9.06 | 8 [-11%] |

| Total LS | 537 | 550 [+4%] |

| Poultry | 851.81 | 950 [12%] |

India continues to be the largest producer of milk in the world with 221.06 million tonnes produced during 2021-22, showing an annual growth of 5.29%. India contributes 23% to the global milk production. The per capita availability of milk is around 444 grams/day in 2021-22. Nearly 45% of the milk production is contributed by Indigenous/Non-Descript Buffaloes followed by 30% by crossbred cows. The Indigenous/Non-descript cows contribute 20% of the total milk production in the country. Goat milk shares a contribution of 3% in the total milk production across the country. The contribution of exotic cows in total milk production is 2%.

Poultry production in India has taken a quantum leap in the last four decades, emerging from conventional farming practices to commercial production systems with state-of-the-art technological interventions. India ranks 3rd in egg production with 129.60 billion numbers produced during 2021-22. The per capita availability during 2021-22 is around 95 eggs per annum. The egg production has shown growth as 6.19% during 2021-22.

Meat production during 2021-22 is 9.29 million tonnes. The Meat production has shown positive growth as 5.62% during 2021-22.

India is the 3rd largest fish producing country in the world and accounts for 7.96% of the global production. The total fish production during FY 22-23 is estimated at 16.25 Million Metric Tonnes (MMT) with a contribution of 12.12 MMT from the inland sector and 4.13 MMT from the marine sector. India ranks second in fish production in the world after China. Inland fish production constitutes about 75 percent of the total fish production of the country and annual growth rate of production has also been high. The fish production in the country has shown continuous and sustained increment since independence. During FY 2021-22, 77 percent of Marine Fisheries potential and 71 percent of the Inland Fisheries potential have been harnessed. Freshwater aquaculture with a share of 34 percent in Inland Fisheries in mid-1980 has increased to about 76 percent in recent years.

| Particulars | Rank | 2020-21 |

|---|---|---|

| Milk [Million Tons] | 1st | 1210 [2021-22] |

| Egg [Billion Nos.] | 3rd | 122.05 |

| Meat [Million Tons] | 6th | 8.8 |

| Fish [Million Metric Tons] | 3rd | 14.73 |

Contribution to Economy

Livestock is an important source of income for landless and marginal farmers and plays an important role in the national economy. Livestock Sector has continuously been growing at Compound Annual Growth Rate (CAGR) of 7.93% (at constant price) from 2014-15 to 2020-21, which is comparable to CAGR of manufacturing at 4.93% (at constant price) and Services at 4.82% (at constant price) and in contrast to Agriculture (Crop Sector) CAGR of 2.05% (at constant price) . Agriculture (crop sector) contributed 8.96 % (at constant prices) of total GVA, whereas livestock sector contributed 4.90% (at constant prices) of total GVA in 2020-21.

The Gross Value Added (GVA) of the livestock sector is about Rs. 11,14,249 crore at current prices during FY 2020-21 which is about 30.87% of Agricultural and Allied Sector GVA and 6.17% of Total GVA. At constant prices (2011-12), the GVA of the livestock sector is about Rs. 6,17,117 crore during FY 2020-21 with a positive growth of 6.13% over previous financial year.

Fisheries has emerged as a sunrise sector and has been an important sector that provides food, nutrition, employment, income and livelihood in India. Transformation of the fisheries sector from traditional to commercial scale has led to a significant contribution to India’s economy. The total Gross Value Added (GVA), at Constant prices, in 2022-2023 is estimated at Rs. 1,37,716 crore that constitutes about 1.09 percent of the total national GVA and 6.72 percent of agricultural GVA. The fisheries sector has been one of the major contributors of foreign exchange earnings, with India being one of the leading seafood exporting nations in the world. During FY 2021-22, export of marine products stood at 1.37 MMT and valued at Rs. 57,586.48 crore (USD: 7.76 billion) with an impressive average annual growth rate of about 10% in recent years.

The animal husbandry, dairying and fisheries sector plays a significant role in supplementing family incomes and generating employment in the rural sector. More than 20.5 million workers are engaged in animal farming and about 87.7% of the livestock is owned by farmers of marginal, small and semi-medium operational holdings. The animal husbandry and dairy sector provides around 50% direct & indirect employment to women in the country which is the highest for any sector in the economy. Around 5.51% of usually working persons are engaged in Animal Production, Mixed Farming, Fishing and Aquaculture during 2020-21. The fisheries sector provides livelihood to 16 million fishers and fish farmers at primary level.

The animal health industry in India with the mission of feeding billions has been bridging the protein gap of carbohydrates among Indians. Moreover, the industry is fast emerging as an important driver of employment and contributor to the economy of India.

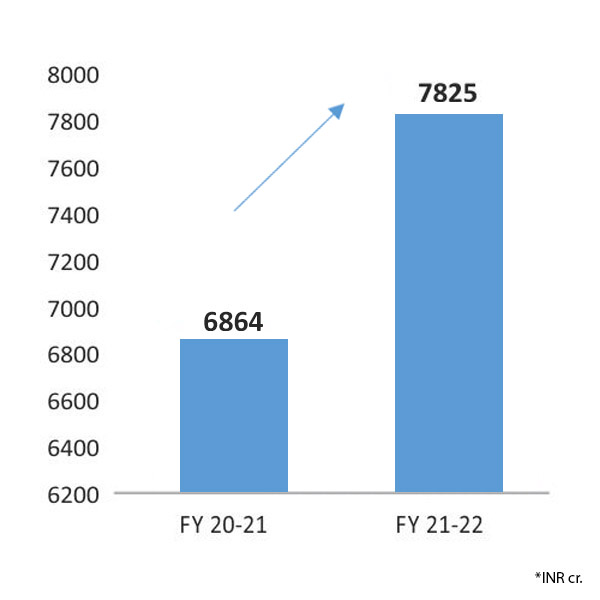

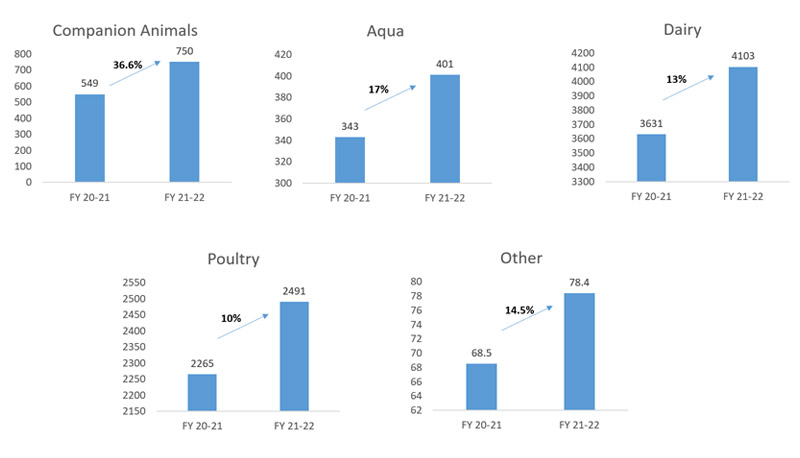

Indian Animal Health Market registered an estimated growth of 14% with total sales of INR 7824.5 cr. (in 2020-21, the market recorded INR 6863.6 cr. after including some regional players and excluding unorganised players and companies with captive consumption).

Indian Animal Health Market

More than 50 per cent of the Indian Animal Health market is contributed by top 10 companies who have established R&D, marketing and distribution strengths. The regional players comprising small and medium sized generic companies have shown aggressive growth trends and entrepreneurship. The last year has also seen the entry of many new Indian and multinational companies directly or by equity holding pattern, contributing positively to the overall landscape.

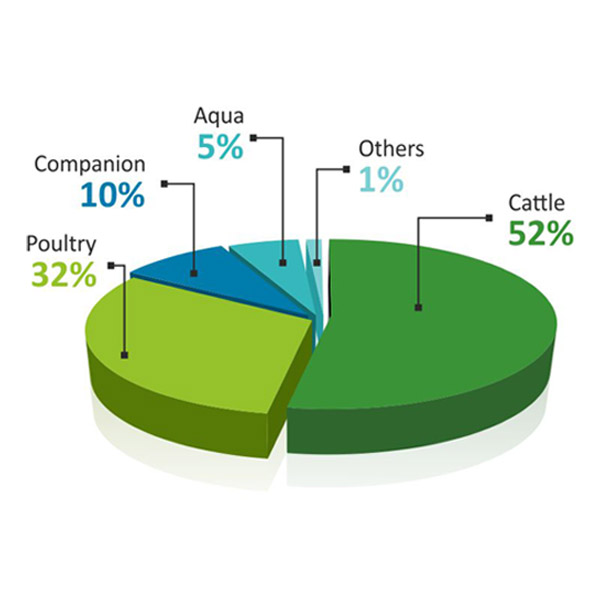

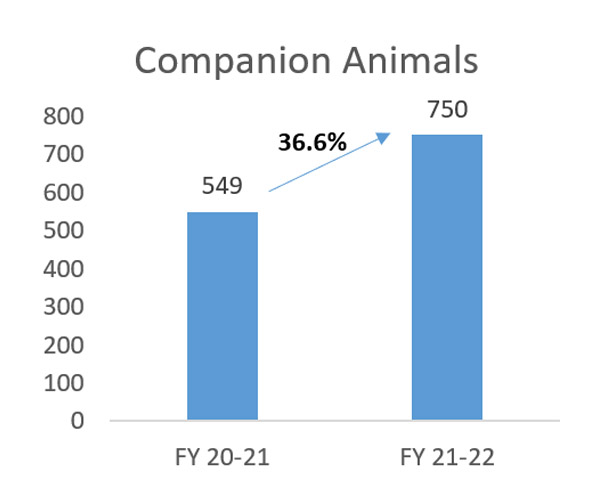

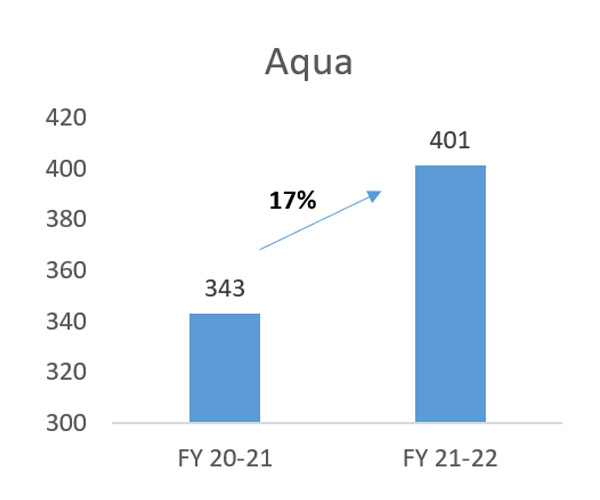

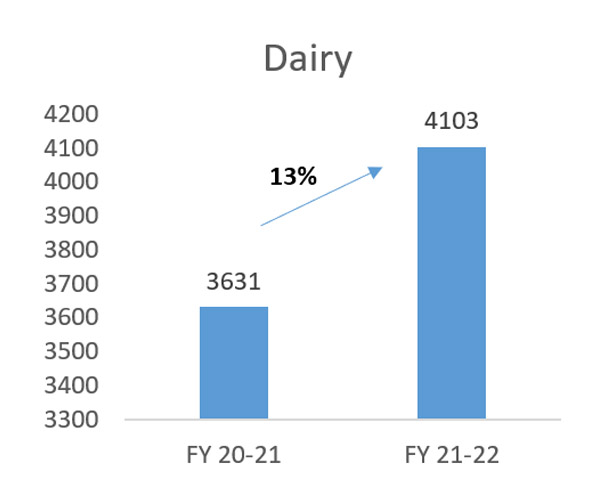

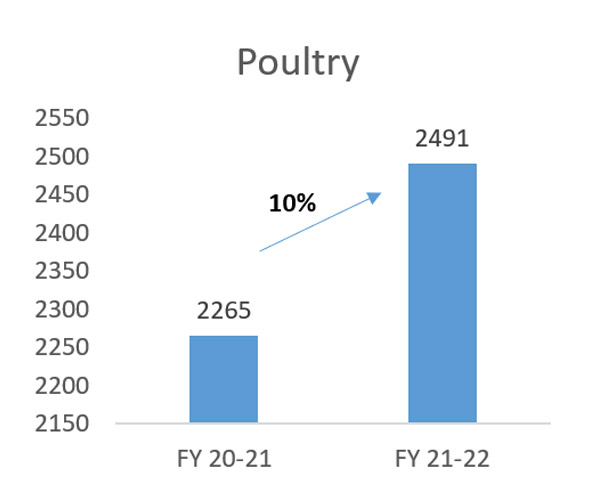

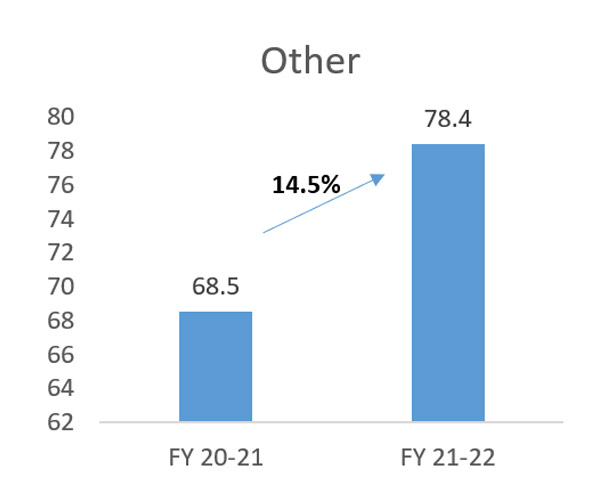

Companion Animal Segment once again registered path breaking growth of more than 36.6%, reinforcing a growing bonding of Man & Pets. Aquaculture Segment registered encouraging growth of 17% due to increase in consumption, exports and increased number of companies in this segment. Dairy Segment is the largest species segment, grew by 13% due to increase in milk consumption which positively affected the usage of Animal health products to maintain health and productivity. Poultry Segment is the second largest species segment, registering a good growth of 10% in spite of problems of high input costs. Sheep and Other Segments have registered an encouraging growth of 14.5% due to increased interest of all stakeholders.

Factors Contributing Growth of Indian Animal Health Market

Dairy Sector - Modernisation of the Indian dairy sector with cooperative networks ensuring better prices to even small farmers is positively impacting the dairy sector. The sector is a great source of employment opportunities in rural areas and is getting tremendous support from the government.

Poultry Sector - Increasing integration has modernised the poultry sector. Improved awareness on right management practices is the key trend in the sector. Increasing consumption of animal protein-based products has fuelled the growth in the sector.

Companion Animal Sector - Expected to grow lucratively during coming years owing to an increase in pet population, increase in consumer spending on pet care and the increase in pet-human bond due to the associated health benefits to humans. Pet parents are spending more time with their pets and this has led to fuelling of need on wellness and care for their pets, leading to increased number of visits to vets thereby increasing the growth in revenue for clinics and pet care.

Aqua Sector - An emerging preferred food commodity. More and more players are entering this segment with innovative product ranges. Export potential is huge.

Digital & Diagnostic Revolution - Knocking at the door of the Animal Health market. Smart sensors, ear tags etc., are becoming effective ways to prevent diseases. Next generation diagnostics like thermal imaging will change Veterinary Healthcare. Veterinary services are improving in its reach to customers and getting more specialised. Digitization of dairy has led to more productivity and less expenses on dairy management and holds a great potential to help the industry.

Biological Segment - The segment will continue to contribute to the industry's growth with continued high growth rate. Industry believes that this growth will be due to the shift from "disease treatment" to "prevention". Diseases of concern are Swine Fever, FMD, Salmonella and other Zoonotic Diseases. Recent studies have shown around 60% of existing infections are zoonotic and at least 75% of emerging diseases of humans are of animal origin.

Feed Supplements / Additives - Consumption of nutritional supplements is increasing due to enhanced awareness about judicious use of antibiotics in farm animals. All immune stimulants like good nutrition, probiotics can protect animals from diseases.

Parasiticides & Disinfectants - Usage is further gaining ground due to impact of vector-borne diseases. It is believed that flies, ticks, mosquitos, bugs, and internal worms affect almost all animals in one way or the other. They also play a critical role in transmission of viral and bacterial diseases.

Ayurveda - Wellness and chemical free life is on rise both in humans and animals. India is becoming a preferred hub in the world for sourcing herbal medicaments. With continued R&D in this area, use of herbal products and premixes is on rise.

Overall Animal Health Industry is expected to keep its momentum of growth, thus contributing significantly to national food requirements, national economy, and welfare of farmers.

The AH sector is expected to witness a growth due to increased need of animal protein, increased population and favourable government support to boost the industry.