The animal health industry in India with the mission of feeding billions has been bridging the protein gap of carbohydrates among Indians. Moreover, the industry is fast emerging as an important driver of employment and contributor to the economy of India.

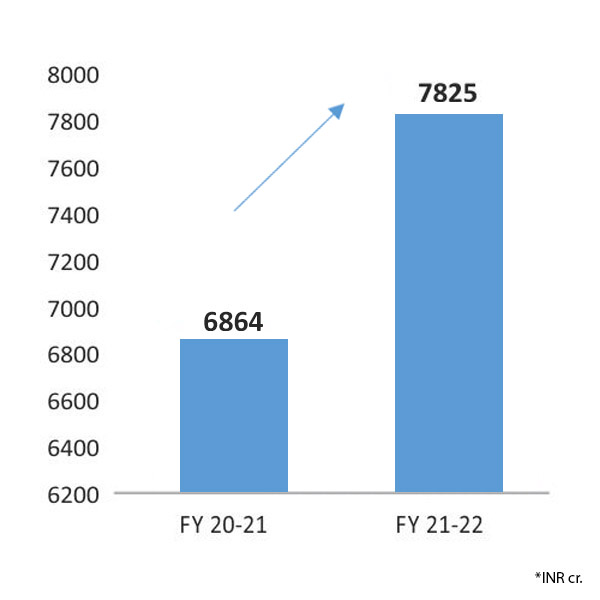

Indian Animal Health Market registered an estimated growth of 14% with total sales of INR 7824.5 cr. (in 2020-21, the market recorded INR 6863.6 cr. after including some regional players and excluding unorganised players and companies with captive consumption).

Indian Animal Health Market

More than 50 per cent of the Indian Animal Health market is contributed by top 10 companies who have established R&D, marketing and distribution strengths. The regional players comprising small and medium sized generic companies have shown aggressive growth trends and entrepreneurship. The last year has also seen the entry of many new Indian and multinational companies directly or by equity holding pattern, contributing positively to the overall landscape.

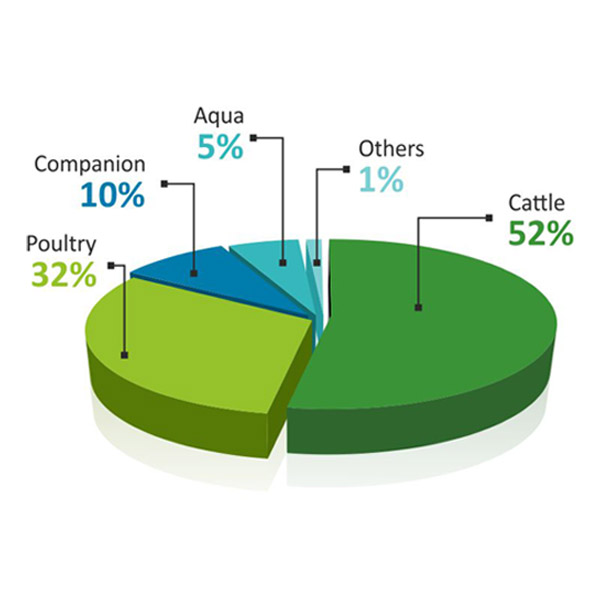

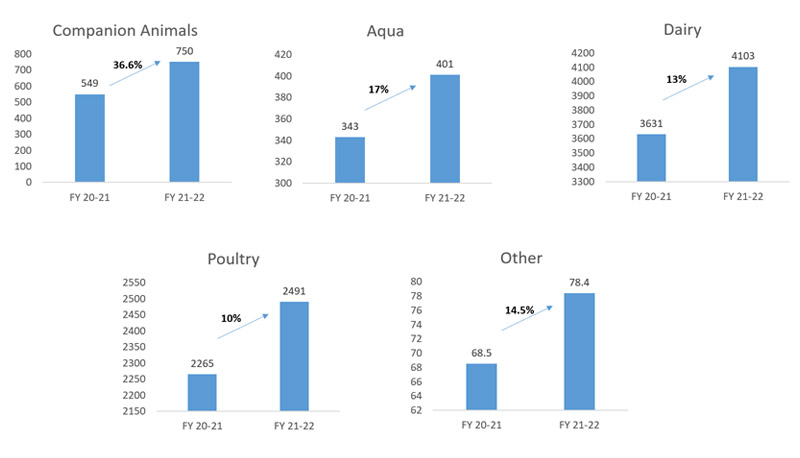

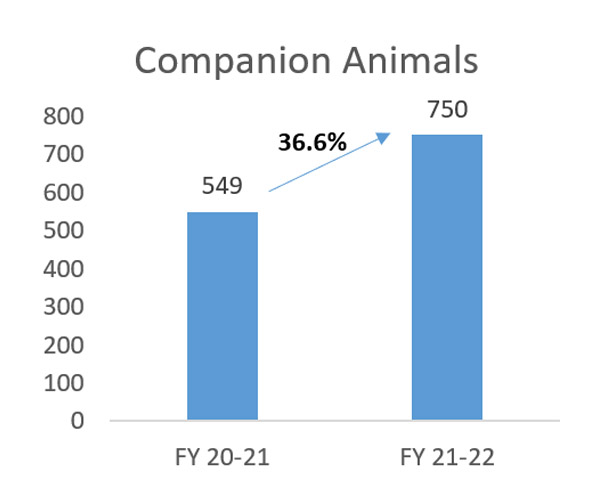

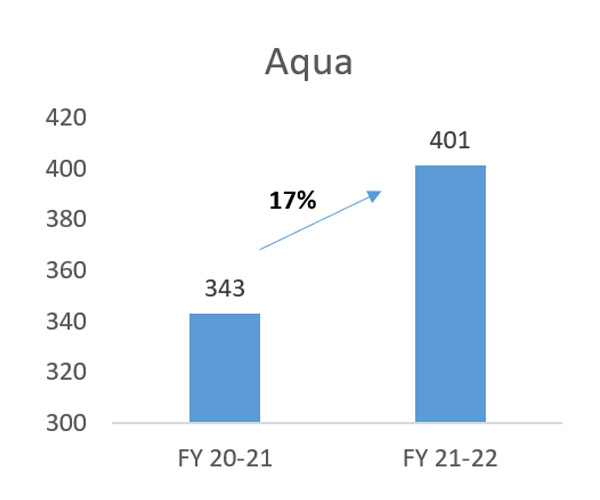

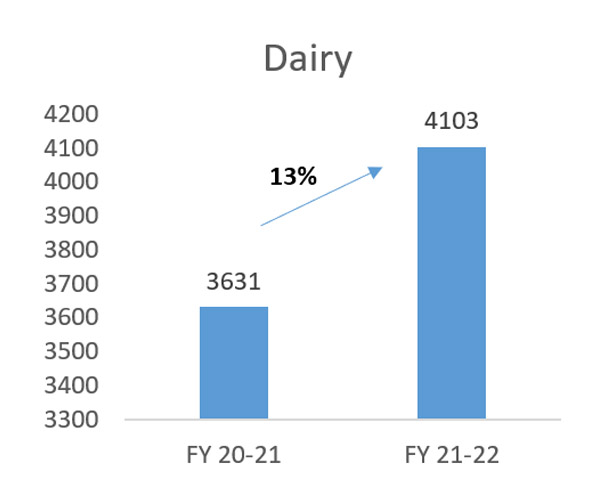

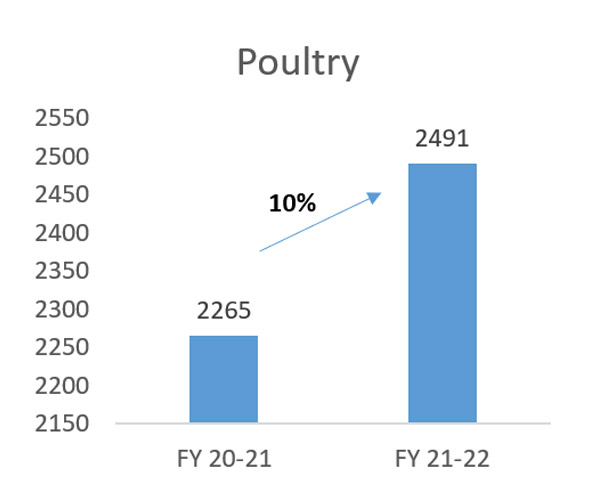

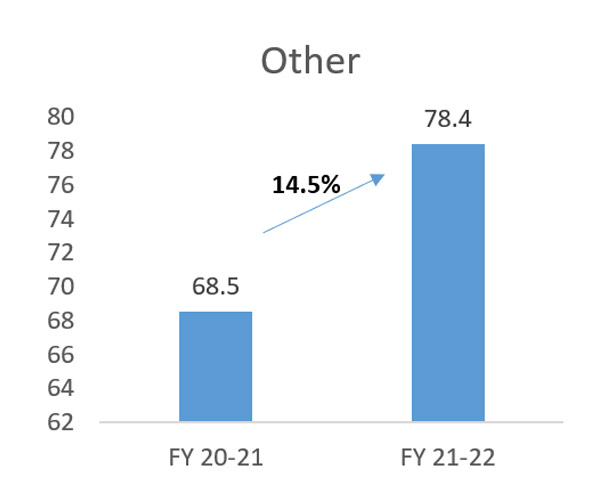

Companion Animal Segment once again registered path breaking growth of more than 36.6%, reinforcing a growing bonding of Man & Pets. Aquaculture Segment registered encouraging growth of 17% due to increase in consumption, exports and increased number of companies in this segment. Dairy Segment is the largest species segment, grew by 13% due to increase in milk consumption which positively affected the usage of Animal health products to maintain health and productivity. Poultry Segment is the second largest species segment, registering a good growth of 10% in spite of problems of high input costs. Sheep and Other Segments have registered an encouraging growth of 14.5% due to increased interest of all stakeholders.

Factors Contributing Growth of Indian Animal Health Market

Dairy Sector - Modernisation of the Indian dairy sector with cooperative networks ensuring better prices to even small farmers is positively impacting the dairy sector. The sector is a great source of employment opportunities in rural areas and is getting tremendous support from the government.

Poultry Sector - Increasing integration has modernised the poultry sector. Improved awareness on right management practices is the key trend in the sector. Increasing consumption of animal protein-based products has fuelled the growth in the sector.

Companion Animal Sector - Expected to grow lucratively during coming years owing to an increase in pet population, increase in consumer spending on pet care and the increase in pet-human bond due to the associated health benefits to humans. Pet parents are spending more time with their pets and this has led to fuelling of need on wellness and care for their pets, leading to increased number of visits to vets thereby increasing the growth in revenue for clinics and pet care.

Aqua Sector - An emerging preferred food commodity. More and more players are entering this segment with innovative product ranges. Export potential is huge.

Digital & Diagnostic Revolution - Knocking at the door of the Animal Health market. Smart sensors, ear tags etc., are becoming effective ways to prevent diseases. Next generation diagnostics like thermal imaging will change Veterinary Healthcare. Veterinary services are improving in its reach to customers and getting more specialised. Digitization of dairy has led to more productivity and less expenses on dairy management and holds a great potential to help the industry.

Biological Segment - The segment will continue to contribute to the industry's growth with continued high growth rate. Industry believes that this growth will be due to the shift from "disease treatment" to "prevention". Diseases of concern are Swine Fever, FMD, Salmonella and other Zoonotic Diseases. Recent studies have shown around 60% of existing infections are zoonotic and at least 75% of emerging diseases of humans are of animal origin.

Feed Supplements / Additives - Consumption of nutritional supplements is increasing due to enhanced awareness about judicious use of antibiotics in farm animals. All immune stimulants like good nutrition, probiotics can protect animals from diseases.

Parasiticides & Disinfectants - Usage is further gaining ground due to impact of vector-borne diseases. It is believed that flies, ticks, mosquitos, bugs, and internal worms affect almost all animals in one way or the other. They also play a critical role in transmission of viral and bacterial diseases.

Ayurveda - Wellness and chemical free life is on rise both in humans and animals. India is becoming a preferred hub in the world for sourcing herbal medicaments. With continued R&D in this area, use of herbal products and premixes is on rise.

Overall Animal Health Industry is expected to keep its momentum of growth, thus contributing significantly to national food requirements, national economy, and welfare of farmers.

The AH sector is expected to witness a growth due to increased need of animal protein, increased population and favourable government support to boost the industry.